Housing activity for the year to January was up by over half, driven by the buy-to-let and remortgaging sectors, new research has found. According to Connells Survey & Valuation, the number of buy-to-let valuations rose by 51% between January 2015 and January 2016, while the remortgaging sector jumped 97% over the same period. Both sectors […]

Housing activity for the year to January was up by over half, driven by the buy-to-let and remortgaging sectors, new research has found.

Housing activity for the year to January was up by over half, driven by the buy-to-let and remortgaging sectors, new research has found.

According to Connells Survey & Valuation, the number of buy-to-let valuations rose by 51% between January 2015 and January 2016, while the remortgaging sector jumped 97% over the same period.

Both sectors experienced steadier performances on a monthly basis. The number of valuations carried out for buy-to-let investors in January climbed 11% on the previous month, while remortgaging activity was down 12% on December.

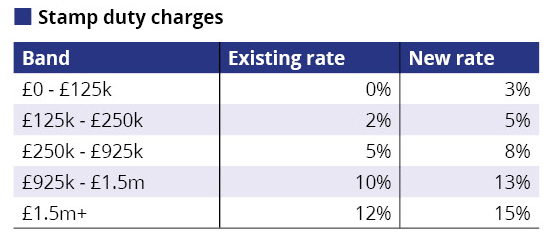

The figures are further evidence of the rush to buy property before the 3% rise in stamp duty arrives in April.

John Bagshaw, corporate services director of Connells Survey & Valuation, said: “Buy-to-let investors are also continuing to flex their muscles. While many are hurrying to expand their portfolios before the Stamp Duty changes kick in in April, others are new-comers to the sector, who simply see buy-to-let as a good investment opportunity – regardless of the tax hikes and hurdles the Treasury throws at it.

“Nevertheless, we can expect the buy-to-let sector to reach a height of activity over the coming months, as some concerned landlords look to counter the effects of any measure that could hit their profit margins.”

As part of the government’s efforts to dampen the buy-to-let market, landlords and second home owners will have to pay an additional 3% in stamp duty from April. Critics have pointed out that this could result in an increase in rents as landlords look to recoup losses.

“The property market is also being buoyed by the recent announcement from the Bank of England that interest rates will be kept at rock bottom levels for the foreseeable future. So long as this remains true – and the general economic outlook stays healthy – acting sooner rather than later will seem the most sensible option to buyers and remortgagors,” said Bagshaw.

“First-time buyers are also getting ever more confident. The volume of affordable homes being built is gradually increasing. This means the hunt for that ideal first home has become less daunting and more achievable. On the plus side, the government has given no indication that it plans to scrap schemes such as Help to Buy anytime soon. However, some savvy first-time buyers realise these won’t last forever. They’ll be eager to take advantage of these schemes sooner rather than later. But overall first-time buyers – like remortgagors, home movers and buy-to-let investors – should be feeling fairly pleased with how 2016 has begun,” he added.