Improving the energy efficiency of your home could increase its value by up to £40,000, a study by mortgage lender Halifax has revealed.

The bank found environmentally-conscious buyers were willing to pay a ‘green premium’ for homes which had the highest Energy Performance rating – A.

The bank found environmentally-conscious buyers were willing to pay a ‘green premium’ for homes which had the highest Energy Performance rating – A.

It said homes in this bracket could go for £40,000 more because of their top environmental credentials.

However, even those homes which had achieved a C or above on their Energy Performance Certificate (EPC) would sell for a higher price.

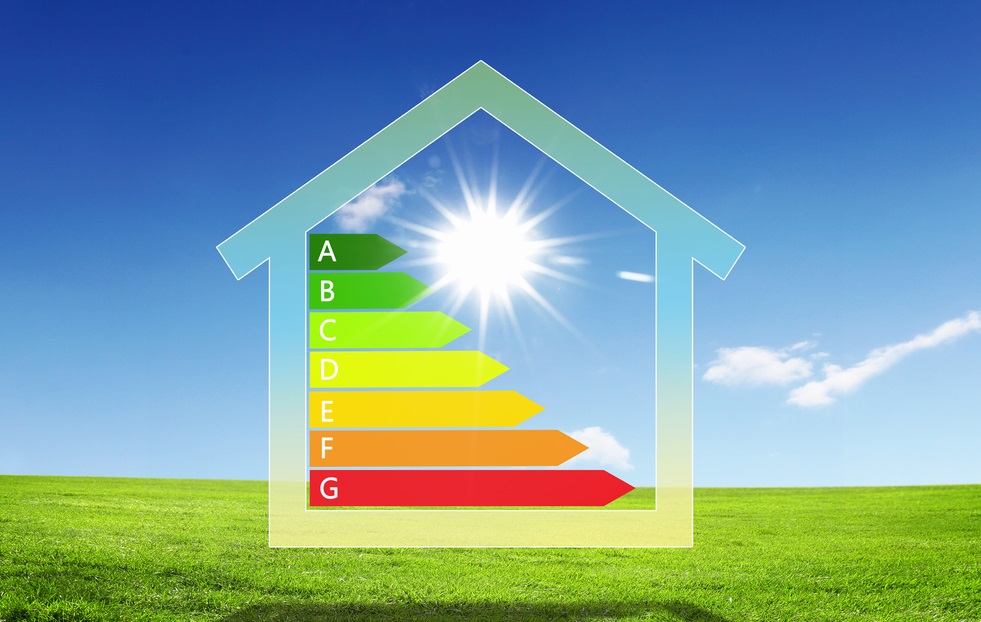

The EPC is obligatory for homes being sold in England and Wales and ratings vary from A to G – with A being the ‘greenest’ and G being the least. It is valid for 10 years.

Halifax said the difference between the average price of a home with an EPC rating of E compared to C is £11,000, which demonstrated the financial returns for more energy efficient properties.

The greatest difference in property price between single EPC bands are those with G and F ratings, with the latter commanding almost £10,000 more on average, the study found.

However, Halifax’s research also discovered, despite the existence of a green premium, 77% of people didn’t know the Energy Performance rating of their own home.

Reducing energy bills

Now the lender is attempting to highlight how making simple adjustments to a property could help save money on energy bills and potentially increase its market value.

Andrew Asaam, mortgages director at Halifax, said: “The housing market has fluctuated significantly in the last 18 months. This, and the effect of lockdown, has made many of us reconsider what we value most in a home.

“Increasingly, buyers are recognising that environmentally friendly properties will reduce their monthly energy bills in addition to their personal carbon footprint.”

He explained how, even small changes can make a difference. “Homeowners at the lower end of the energy efficiency scale are likely to see the greatest returns on their investments, even from making simple changes like switching to LED bulbs or adding loft insulation,” Andrew said.

“There’s a huge opportunity for more people to get on board with this and reap the rewards.”

Halifax’s tips for making your home greener

As Andrew explained, improving the energy efficiency of your home doesn’t have to cost thousands – simply swapping out regular lightbulbs for more efficient LED bulbs or adding draught proofing measures to external doors can make a difference.

Here are some ideas from Halifax to help you…

Check the official government EPC website

Knowing your home’s EPC is vital to understanding which steps are the most appropriate to take in order to improve it.

You can find the EPC of any property on the government’s EPC site, along with suggested improvements to help reach its potential here.

Carry out an energy efficiency health check

The first step to a more sustainable home is identifying the areas for improvement that will have the most impact. You can find a tailored action plan on the green upgrades that you should consider, here.

Switch to energy-saving lighting

One of the quickest and simplest changes you can make that will make a huge difference to your energy bills is to replace all your home’s current light bulbs with energy-saving light bulbs.

Use smart thermostats

A smart thermostat will help you save money by heating your home more intelligently. It’ll learn the best way to keep you warm at home while using the minimum possible energy.

The more you use it, the more efficient it will become.

Upgrade your boiler

Swapping out your old boiler for a newer, more efficient condensing boiler is a sure-fire way to make your home greener.

With a larger heat exchanger, they recover more heat than old models and will give a lasting reduction on your energy bills. If you do decide to upgrade, it’s worth doing some research to work out the best option for your home.

Invest in solar energy

You can start generating your own renewable electricity by making use of the free energy from the sun, with solar panels. As well as cutting down your household bills, solar panels are much greener solutions as the energy is renewable.