An analysis of 20,000 home theft cases by The Co-operative Insurance shows that the cost of claims has risen dramatically over the past two years.

An analysis of 20,000 home theft cases by The Co-operative Insurance shows that the cost of claims has risen dramatically over the past two years.

The data shows that the cost of theft claims leapt by eight per cent in 2010 and then by a further nine per cent just last year – its sharpest rise in the past decade. However, in the three years before (2007, 2008 and 2009) the cost of theft claims remained flat.

This means that the average burglary claim now costs £225 more than it did just two years ago.

However, despite the rising cost of claims, the number of burglaries reported to the insurance company by customers has remained steady over the past five years.

Lee Mooney, head of home insurance at The Co-operative, said: “We’ve seen the average cost of a burglary rise dramatically over the past two years, which we believe is due to burglars stealing higher value items than they used to several years ago.

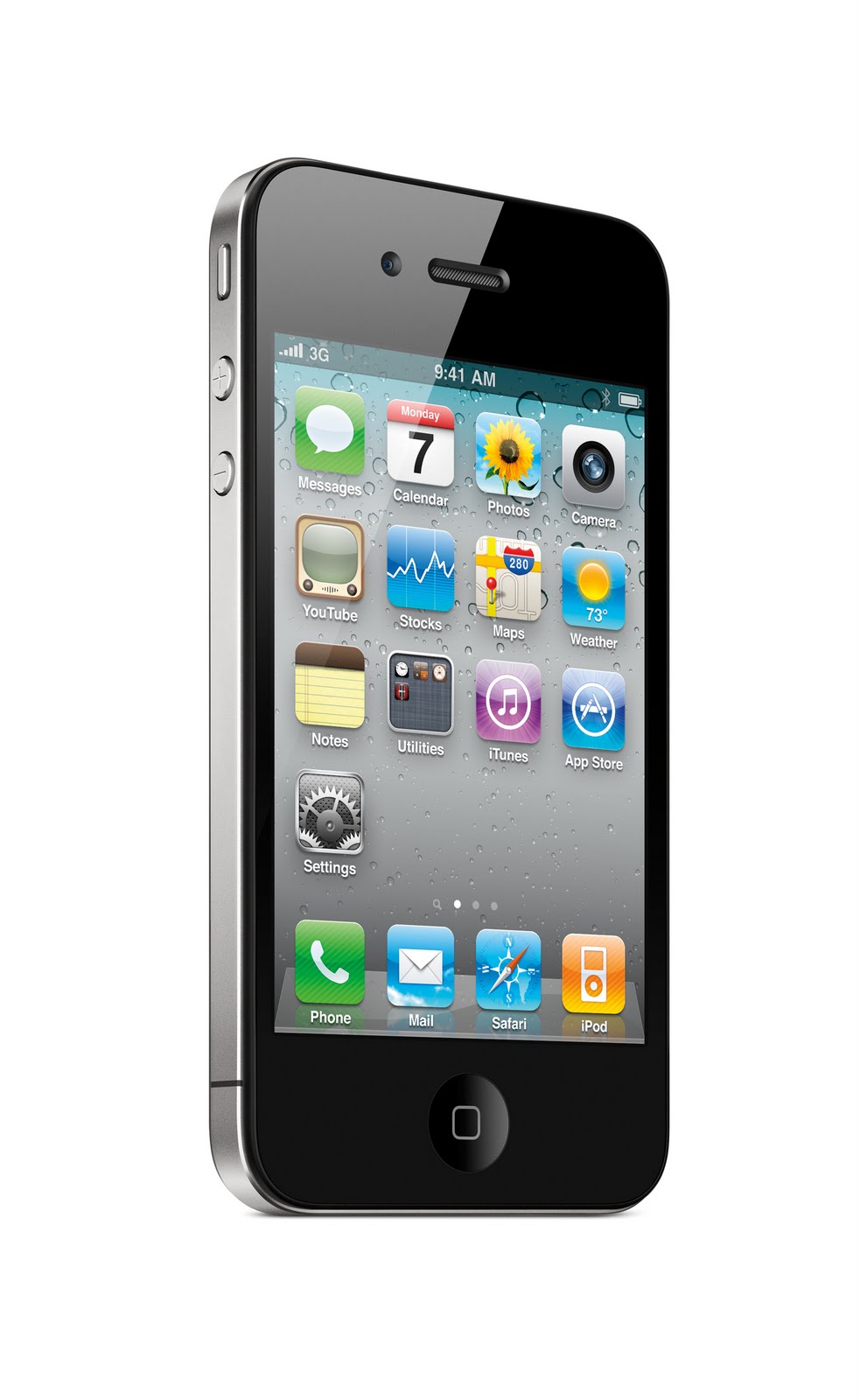

“Ten or so years ago most of us owned bulky, heavy electrical items such as desk-top computers and CD players, which were much harder to steal. The average home is now cluttered with high-tech electronic gadgets like smart phones, games consoles and laptops, which are expensive and easy to steal because of their size.

“Because most people do own many portable, high value items, it’s important to make sure you have adequate home contents insurance in case of a burglary. Keeping a note of the model and serial number of any electronic equipment will make it easier in the event that you do have to claim. It’s also a good idea to mark your valuables in ultra violet ink so they can be returned to you easily if found.”