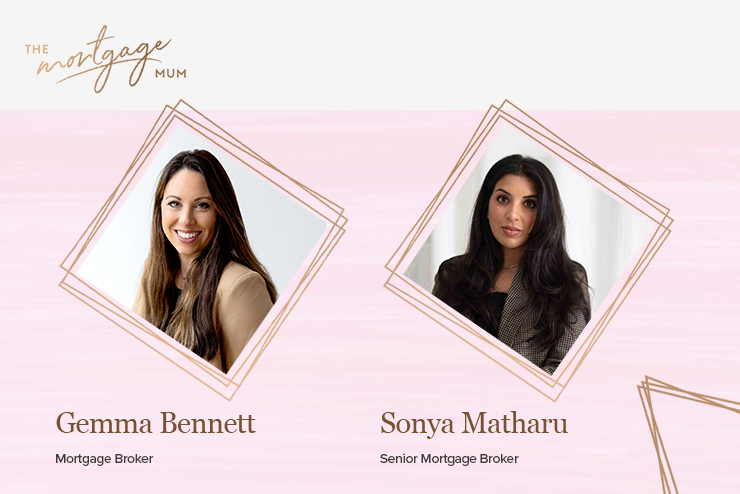

We are thrilled to introduce our new columnists, Gemma Bennett and Sonya Matharu from The Mortgage Mum. Here they explain how they help people achieve their goals and dreams and why discussing your mortgage needn’t be daunting…

Does the idea of taking out a mortgage terrify you? Do you wish you had someone to hold your hand through the entire process?

Does the idea of taking out a mortgage terrify you? Do you wish you had someone to hold your hand through the entire process?

Well, that’s what our new columnists Sonya Matharu and Gemma Bennett from The Mortgage Mum do every day.

And they’ve kindly taken time out of their busy schedule to guide you through each stage via a monthly column here on the What Mortgage website.

Before their column kicks off next week, we found out a bit more about Sonya and Gemma and asked them for a few mortgage tips…

Hi Gemma and Sonya, welcome to the What Mortgage team. Can you please tell us a bit more about your job and how you help people who are looking for a mortgage?

Gemma: As a mortgage broker my job is to assist people in finding the most suitable mortgage product for their individual needs. I feel my job is also to inform and educate the clients about the recommendation, so they remain in control of the financial choice.

So much of my job involves getting to know the clients specific set of circumstances and matching up the cheapest most suitable product for them now but also for their future needs as much as possible too.

Ideally you are facilitating and assisting a person’s mortgage needs throughout their journey as a homeowner so it really can be very holistic, as we go through the many changes in life.

Sonya: Of course! My name is Sonya Matharu and I’m a senior mortgage broker. Through The Mortgage Mum, I get to help my clients buy or refinance their properties and move towards their dream homes.

However, mortgages can go so much deeper than that and I firmly believe with the right advice, and the right mortgage, people can achieve the lifestyle they want to lead, which in turn can help them to achieve their goals and dreams.

What’s the most difficult part of buying a home and how can you help?

Gemma: Lender policies are varied so, at times, clients find it difficult to navigate the various aspects of lenders’ criteria.

For example, understanding how various income is calculated, such as overtime, commission, bonus’s, shift allowance, benefits. Then there’s self-employment requirements and things like temporary or fixed term contracts.

All the above tend to require a certain amount of market knowledge and assistance to get the best outcomes. I also find first-time buyers are best to work with a broker initially.

Understandably the entire process is brand new and can be pretty daunting – to have someone holding your hand and explaining as you go is essential for the first, and potentially biggest, financial commitment of your life.

Sonya: I would say getting started is the most difficult part! There are so many unknown variables when getting a mortgage, and the hardest bit can be knowing where to go or who to turn to for help understanding that.

But having the right broker in your corner can change your whole experience. Upon speaking with my clients, I’ve found that there are a lot of people who feel intimidated when meeting with a mortgage broker as they feel nervous that they won’t understand the lingo, or they’re worried about being obligated to then take out a mortgage.

But that’s not the case at all. I help to combat this by simplifying it, working hard to demystify the process and helping my clients understand the journey and what needs to happen when so that they feel empowered when making financial decisions.

This helps them to break down the process and follow along with curiosity, rather than concern—and seeing this change brings so much joy to my job role.

What is a typical working day like for you?

Gemma: The Mortgage Mum is based around a truly flexible working model, so there is no nine to five here. We choose our own work balance to suit.

I have three set office days (9am to 4pm) and the other two days I am in ‘Mum’ mode with my toddler, I avoid any client calls on those days but can answer quick questions and emails.

When required I flex my time more, for example I may work in the evenings or weekends flexibly.

My working days consist of client calls via video usually. Researching and sourcing cases for clients, talking to lenders over the phone about cases or new policies to stay on top of the ever-changing market.

The mortgage mum team is spread across the UK and working remotely, but there’s great camaraderie. Not a day goes by where we aren’t in contact talking with each other about the market, helping support one another.

Sonya: Honestly, no two days are the same—especially with the current chaos the economy is causing. But no matter what is happening in the financial climate, I ensure I follow a routine as I feel that’s how I operate best.

For me, this starts between 6 and 6.30 am. I go downstairs and make a cup of tea and take time to journal, stretch and then check any emails that have come through in the evening.

I then shower and get ready for the day! I’m usually at my desk around 8ish ready to crack on with meetings and casework, which involves underwriting client documents, researching lender’s products and criteria, calculating affordability, submitting applications, liaising with solicitors, estate agents and lenders—to name a few things!

After this, I work on creating content for my social channels and website where I help my audience to understand the world of mortgages and finance.

What are the most difficult and the most rewarding parts of your job?

Gemma: I’d say one of the most difficult parts is debunking the assumptions people make around mortgages.

Perhaps believing they can’t get a mortgage for some reason or misunderstanding how much or how it works.

I find sometimes people can create their own barriers before the process has even begun and actually the best advice is always to get advice.

It’s only been from working in the mortgage market that I am aware of the vast varieties of differences amongst lender criteria and how they can accommodate.

So, a decline from one lender based on a specific criteria can absolutely be an accept from another.

I want word to get out that discussing your mortgage needs and circumstances needn’t be daunting.

I find the puzzle solving element of my job very rewarding too – assessing someone’s individual needs and finding the best solution is extremely satisfying.

I am very much a people person, so working with my clients makes me happy too. It’s one of the biggest financial commitments of your life and in most cases directly linked to your actual HOME, its very emotional and I’m here for it!

It’s so rewarding to get the email form the lender saying ‘MORTGAGE OFFERED!’, I still get such a buzz from this.

Sonya: The most rewarding part is hearing how overjoyed people are when their mortgage is approved and they get to move into their dream home.

There’s no feeling like it. Essentially, my job is helping people to achieve a part of their dreams and I love it.

The most difficult part is something that I’m actively dedicated to combating, and that’s helping people to understand the role of a broker. There’s still a huge stigma in the industry and whilst the market generally values the services of a broker, they don’t understand the wider breadth of what brokers can do, or how financial services can go deeper than mortgage advice and stepping onto the property ladder.

What are your top three tips for anyone preparing to take out a mortgage?

Gemma:

- Speak to a broker about preparing and discover what documents you’ll need. There’s a core list of standard documents but you might also need certain extras.

- Be prepared. Dedicate time to collating all your relevant documents together in one place so you feel more organised before you start searching for properties.

- Have an idea about your future plans. What you need now and how your life may change in the next vie years so you can discuss this with your broker and ensure really great advice for now and the future. It’ll make a difference to what mortgage product suits you best.

Sonya:

- Speak to a Broker as early as possible. Even earlier than you think you should. Like, as early as when you’re saving and a mortgage feels like a pipe dream. It will help you prepare, plan and remain on track.

- If you do not monitor your credit report already, start immediately.

- Make sure your address is up to date on all documents such as bank statements, payslips, ID etc. to avoid unnecessary delays.

If you weren’t a mortgage broker – what would be your job?

Gemma: Prior to broking I was a CBT therapist and holistic wellbeing practitioner for over 10 years. I still do some of this work occasionally and recently I have bought my wellbeing practices into The Mortgage Mum Team.

I love this work and so I know that mindset and wellbeing are key to any work I do in life.

As a bit of curve ball, I always fancied being a kids’ TV presenter too. I’d be in my element!

Sonya: Honestly, I have no idea. I kind of stumbled into the world of mortgages and now I can’t imagine doing anything else. It would have to be something that involves helping people to achieve their goals though, that’s a non-negotiable for me!

When you are not helping people with their mortgages, what are you most likely to be doing…?

Gemma: I have children aged seven and two, so they keep me busy day to day, but outside of mum stuff I do love a hobby and actually have a number of interests.

I studied musical theatre when I was younger and was a keen dancer, so I regularly attend dance class still, it’s like my meditation. I even recently tried aerial hoop which was so hard but really enjoyable.

I am part of a local improvised comedy company and we do an annual improvised pantomime run. It’s mad and ridiculous but so, so fun.

My husband and I own an independent gym and so training is also up there in my priorities. Movement and keeping my body feeling string and agile is so important to my sense of happiness.

Oh, and I do love a tree. I am grateful to live near a few areas of woodland and I am often found in the woods, usually with my kids but breathing in the trees, they are glorious.

Sonya: My husband and I are huge foodies so we’ll either be out fine dining or cooking at home. Or I’ll be chilling with my family!

I’m from a big close-knit family and we genuinely enjoy spending time together so we’re basically always together.

Otherwise, you’ll find me at home, in loungewear surrounded by candles with a cup of tea. I’m a total grandma at heart and I love it.

[box style=”4″]

Connect with The Mortgage Mum team

You can connect with Sonya via her website www.sonyamatharu.com and you can contact Gemma via email Gemma@themortgagemum.co.uk: or at her website, here.

gemmabennett_themortgagemum.co.uk

https://www.instagram.com/sonyamatharu_/

Gemma Bennett _The Mortgage Mum

https://www.facebook.com/sonyamatharu

Gemma Bennett

https://www.linkedin.com/in/sonya-matharu-349265182/

[/box]