Mortgage borrowing shot up in January, driven by buy-to-let investors looking to beat the April stamp duty deadline, industry figures show. According to the British Bankers’ Association, gross mortgage borrowing was £13.6 billion in January, a 38% jump from the same month last year. A total of 80,285 mortgages were approved last month, the highest […]

Mortgage borrowing shot up in January, driven by buy-to-let investors looking to beat the April stamp duty deadline, industry figures show.

Mortgage borrowing shot up in January, driven by buy-to-let investors looking to beat the April stamp duty deadline, industry figures show.

According to the British Bankers’ Association, gross mortgage borrowing was £13.6 billion in January, a 38% jump from the same month last year.

A total of 80,285 mortgages were approved last month, the highest figure since mid-2008.

The number of mortgage approvals in January was 33% higher than a year ago, with remortgaging up 42% and house purchase up 27%.

Richard Woolhouse, chief economist at the BBA, said: “The start of the year has seen a significant rise in mortgage borrowing. It seems that this has been driven, in part, by borrowers looking to get ahead of the increases in stamp duty for buy-to-let and second home buyers scheduled to come into effect in April.

“Net lending to non-financial companies saw the biggest monthly jump since July 2008 as businesses take advantage of record low interest rates. Demand from the transport, storage and communication and construction sectors was particularly strong.”

Brian Murphy, head of lending at the Mortgage Advice Bureau, said: “There is plenty of appetite among borrowers and lenders alike in the mortgage market, with January seeing a post-recession high in borrowing.

“As the BBA suggests, this has been driven in part by a growth in demand from buy-to-let investors looking to access the market ahead of April’s changes to stamp duty. The record low mortgage rates available on the market have also contributed to this spike in activity and have helped encourage borrowers to lock in to very affordable deals.”

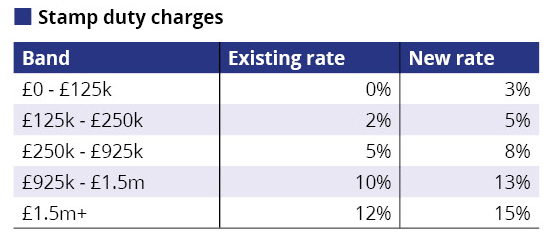

Stamp duty will rise by 3% for landlords and second home owners from 1 April as part of the government’s efforts to dampen the buy-to-let market and free up property for first-time buyers.

Under the changes, the stamp duty on a £250,000 buy-to-let property will rise from £2,500 to £10,000, while the rate for a £400,000 property will more than double from £10,000 to £22,000. The amount of tax relief landlords can claim on properties is also set to fall from April 2017.