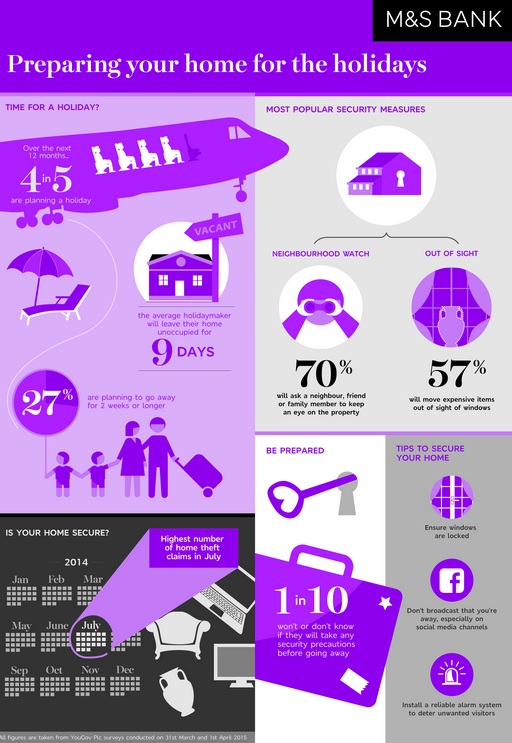

With the average Briton planning to take at least nine days off in the summer to go on holiday, a lot of people will be leaving their homes empty, and caution is advised, says M&S Bank.

Research by M&S Home Insurance shows that the number of theft claims last year peaked in July, so holidaymakers should prepare their home by taking some simple security precautions before they depart, the bank advises.

Research by M&S Home Insurance shows that the number of theft claims last year peaked in July, so holidaymakers should prepare their home by taking some simple security precautions before they depart, the bank advises.

The most popular security measure taken before going on holiday is asking a neighbour, friend or family member to keep an eye on the property (70 per cent), followed by moving expensive items out of sight of windows (57 per cent). More than one in ten (12 per cent) won’t, or don’t know if they will, take any security precautions for their home before going away.

Nearly one in ten (nine per cent) said that their home had been burgled previously and of those, nearly a quarter (22 per cent) said this had happened more than once.

The majority of those that have been burgled previously said the thief had forced access to their home via a window or door (63 per cent).

However, homeowners are encouraged to be extra vigilant when leaving the home, particularly for extended periods, with nearly one in ten of those who have been burgled previously (eight per cent) reporting that the burglar gained access via an accidentally unlocked window. In addition, four per cent said the burglar entered the house via an open garage door.

Paul Stokes, head of products at M&S Bank, said: “The summer period is an incredibly popular time for the family to get away and so we’re urging homeowners to take a little extra time to ensure their home is secure. By taking a few simple security measures before they jet off, homeowners will have added peace of mind, helping them to relax and enjoy their break.

“In addition, holidaymakers should also check their home insurance policy and ensure they’re familiar with any exclusions or conditions, such as limits on value and how long the property can be left unoccupied, particularly if heading away for extended periods. This will help ensure the policy provides adequate cover, should the worst happen.”