The housing market could swallow 10 per cent of the defined contribution (DC) pension wealth held by people aged 55 to 64, new research from estate agency Savills reveals. The proportion of people with a DC pension in this age group is 29 per cent and the median value of their retirement savings pot is […]

The housing market could swallow 10 per cent of the defined contribution (DC) pension wealth held by people aged 55 to 64, new research from estate agency Savills reveals.

The proportion of people with a DC pension in this age group is 29 per cent and the median value of their retirement savings pot is £25,000. In their study of the impact of the recent pension reforms would have on the property market, Savills have estimated that DC pension wealth of 55-to-64 year olds stands at around £120 billion, which is half the value of annual residential property transactions (total value was £254 billion in 2013).

The proportion of people with a DC pension in this age group is 29 per cent and the median value of their retirement savings pot is £25,000. In their study of the impact of the recent pension reforms would have on the property market, Savills have estimated that DC pension wealth of 55-to-64 year olds stands at around £120 billion, which is half the value of annual residential property transactions (total value was £254 billion in 2013).

How big a part of that money will go into residential property investments depends on a couple of factors, Savills’ researchers say. The first factor is the distribution of pension wealth and the second is the actual inclination of retired people to invest in property.

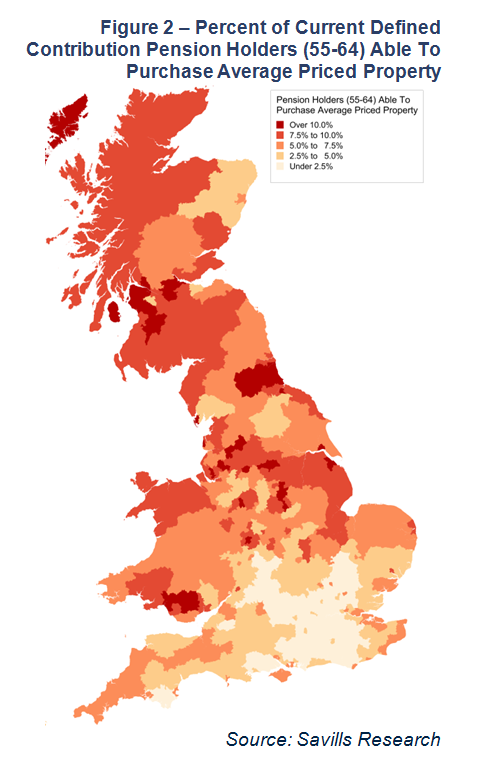

Once income tax liabilities are taken into account, assuming there is no other source of income, only the top 7 per cent of those pension holders could afford to buy an average priced property outright (costing around £180,000) and this is due to the skewed distribution of pension wealth.

When it comes to the propensity to invest, holders of larger pension pots are more likely to already had invested in a house and therefore may be less inclined to spend more money on the residential property market.

Taking these factors into account Savills is making the assumption that DC pot holders aged 55-64 would spend around a tenth of their combined wealth on housing. Dividing that figure over ten years gives a possible investment of £1.2 billion per year, which corresponds to 0.5 per cent of recent market turnover and around 10,000 transactions annually. At those levels, the reforms will have a limited effect on national house prices although we may see a short-term burst of activity in lower value markets, Savills concludes.