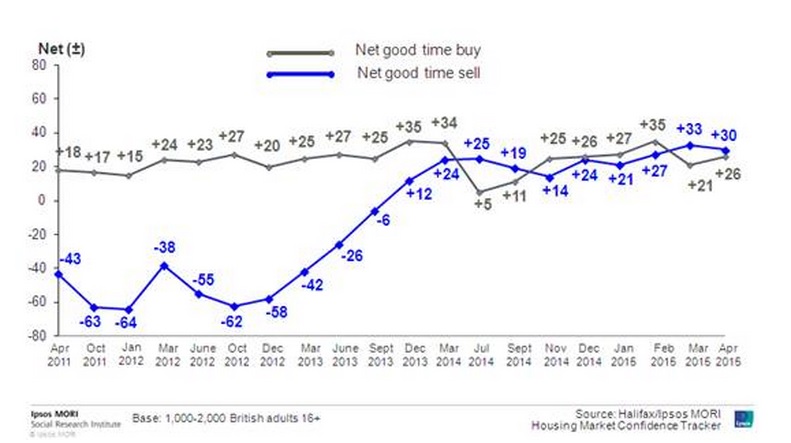

The number of people who expect good home purchase opportunities on the market in the next 12 months has increased in April compared to the previous month, the latest Halifax data shows.

Although consumers overall are less confident in the house price growth over the next year, their optimism should improve in the near future thanks to factors such as the record-low mortgage rates, falling swap rates, negative inflation and the Bank of England’s Monetary Policy Committee’s assurance that the base rate will remain at 0.5 per cent. Employment is also increasing and the economy continues to grow although at a slower pace.

Although consumers overall are less confident in the house price growth over the next year, their optimism should improve in the near future thanks to factors such as the record-low mortgage rates, falling swap rates, negative inflation and the Bank of England’s Monetary Policy Committee’s assurance that the base rate will remain at 0.5 per cent. Employment is also increasing and the economy continues to grow although at a slower pace.

In April, nearly two-thirds of consumers (63 per cent) expected the average property price to be higher in one year’s time. This is lower than the 67 per cent measured in March, according to the Halifax Housing Market Confidence Tracker.

Craig McKinlay, mortgages director at Halifax, said:

“With inflation now at its lowest level since records began, unemployment falling, and the economy still growing, the fundamentals for the housing market remain positive. Going forward the key factor in how consumers adjust to any changes in rates will be the way in which they manage their disposable income.”