Seller asking prices for properties coming to the UK market have hit an all-time high in April, according to the latest house price index of property portal Rightmove. The average asking price in April went up by 1.6 per cent on the previous month and by 4.7 per cent on the year to a new […]

Seller asking prices for properties coming to the UK market have hit an all-time high in April, according to the latest house price index of property portal Rightmove.

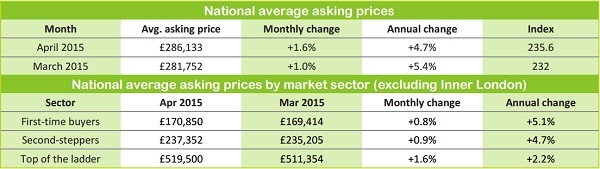

The average asking price in April went up by 1.6 per cent on the previous month and by 4.7 per cent on the year to a new record of £286,133.

The average asking price in April went up by 1.6 per cent on the previous month and by 4.7 per cent on the year to a new record of £286,133.

Prices grow as the shortage of property on the market is expanding. The slump in the number of properties entering the market for sale is clashing with the increased demand from buyers looking for a suitable purchase. This is pushing up prices to new highs.

The situation is worst in the southern regions (Greater London, South East, East of England and the South West) with London leading the way in price jumps. Since the last General Election in 2010, the average price of property coming to market in the southern regions of the country has gone up by 27.5 per cent. The rate of property price increase in London for the same period is staggering 49 per cent.

“With low wage inflation, the increasing cost of housing is another burden for many. The problem is especially acute in the south, particularly those areas influenced by the high demand for housing within reach of the capital, ” Miles Shipside, director and housing market analyst at Rightmove, said.

Commenting on this month’s findings, he added:

“Record high housing demand and an under-supply of homes have delivered a new all-time high in the price of property coming to market in the month before the election. The high cost of housing is a big concern for many home-hunters, so the contents of the respective party manifestos and well thought-out sustainable solutions to the lack of affordable housing supply will be high on many voters’ agendas too. While the annual rate of price increases may be dropping back, down from 5.4% last month to 4.7% this month, it’s of little comfort to buyers as even more modest increases stretch buyers’ finances into new territory with prices at record average highs. Furthermore, the rapid fall in general inflation means that the inflationadjusted rate of house price growth remains high.”