Many property experts believe the shortage of homes to sell is preventing stronger growth of the housing market currently, new survey by mover conveyancing services provider Myhomemove shows. Almost all (90 per cent) of the polled experts said they believe the market is being held back at present and of nearly half of them (47 per […]

Many property experts believe the shortage of homes to sell is preventing stronger growth of the housing market currently, new survey by mover conveyancing services provider Myhomemove shows.

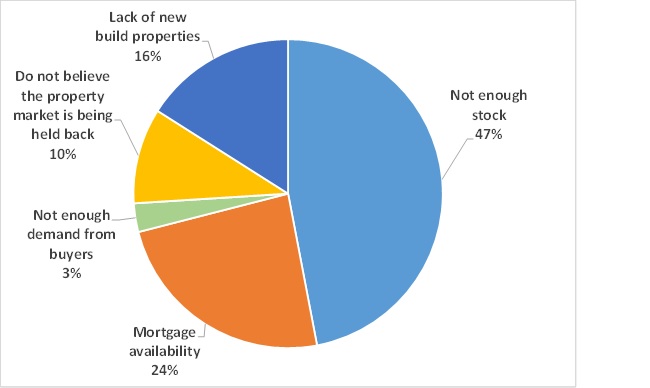

Almost all (90 per cent) of the polled experts said they believe the market is being held back at present and of nearly half of them (47 per cent) said the shortage of stock is to blame for that.

Mortgage availability was named as the second-biggest obstacle for further market growth, with around a quarter (24 per cent) of property professionals seeing it as a cause for the slowdown.

Election result pleases most property professionals

Most experts are happy with the housing policies included in the Conservative party manifesto.

The majority of those polled (80 per cent) strongly support the Help to Buy scheme for new build purchases to 2020.

The Tories’ starter homes scheme also enjoyed strong support with 65 per cent of survey respondents backing it. Almost two-fifths (38 per cent) of professionals consider achievable the 200,000 starter homes target set by the Conservatives in their manifesto.

While having support the Right to Buy scheme is reason for doubt for around a third of the experts, as 27 per cent of them said they were not sure whether the plan is realistic. Right to Buy is considered realistic by 43 per cent of the polled experts.

The policy that split opinions in two was the planned reduction of inheritance tax on the family home, with 42 per cent of professionals in favour and 38 per cent against it.

Commenting on the findings, Doug Crawford, CEO of myhomemove, said that property professionals are clearly concerned about the obstacles that are holding back property transaction numbers.

Commenting on the findings, Doug Crawford, CEO of myhomemove, said that property professionals are clearly concerned about the obstacles that are holding back property transaction numbers.

“The good news is that the decisive election result could provide a confidence boost to consumers that will mean more properties are put on the market.

“The main housing policies outlined by the new Conservative Government in its manifesto are, for the most part, popular within the industry. The question now is whether the Government can deliver on its promises and how quickly it can do so. Some policies, like extending Help-to-Buy, are far simpler to deliver than others, like the proposed Right-to-Build scheme,” he said.