Michelle Niziol, director at IMS Independent Mortgage Solutions, and contestant on The Apprentice 2016, advises on what borrowers should do if they are thinking of remortgaging. With interest rates so low remortgaging is proving to be popular.

Michelle Niziol, director at IMS Independent Mortgage Solutions, and contestant on The Apprentice 2016, advises on what borrowers should do if they are thinking of remortgaging. With interest rates so low remortgaging is proving to be popular.

Many households have seen a squeeze on income and spending since the credit crunch, with the need to budget and make savings ever more apparent.

With interest rates at an historic low and lenders having introduced a greater range of mortgages to the market, the number of remortgages has increased steadily.

Figures from the Council of Mortgage Lenders showed gross remortgaging, i.e the total amount of remortgage lending, had risen to £6.1 billion in October 2016, the highest monthly figure since January 2009.

We expect the remortgage market to continue growing this year, as more consumers understand the benefits of switching and the potential savings to be had. According to research by TSB, almost a third (31%) of eligible homeowners are planning to cash in on low interest rates and 25% of those were preparing to remortgage in January 2017.

But before you make an appointment to see your lender or a mortgage broker, take some time to find out whether remortgaging is right for you. It is true that remortgaging isn’t right for everyone but the key is to find out what your options are and be sure before you make any decisions.

Certainly, if you are coming towards the end of your current deal or are on your lender’s standard variable rate, you should look to see if you can get a better deal elsewhere. Most lenders offer free valuation and legal fees for customers who are taking out a remortgage, so there’s another bonus. The money you save could go on holidays, home improvements or into savings.

Why your personal circumstances matter

Your personal circumstances are likely to have changed since you took out your mortgage – your employment status may be different, you may be earning more, your property may have increased in value.

Employment status

If you are no longer in employment you may find it harder to get a mortgage with another lender. Lenders’ criteria have become much stricter over recent years due to the implementation of new regulations. This is ultimately to safeguard borrowers from an increase in interest rates and ensure you can afford your mortgage but this may mean that based on a new affordability score a lender won’t approve your application.

Moving home

If you are planning to move home in the near future it is often beneficial to get a flexible mortgage. A flexible mortgage is a normal mortgage but with extra flexible features, such as the ability to make overpayments, the ability to arrange a payment holiday, or port (transfer) your mortgage to another property.

A tracker mortgage is worth considering as a flexible mortgage. Some are offset, some have no tie-ins, and they can offer lower payments than a fixed mortgage. An offset mortgage (see page 45 for more on this) is great if you want to build an extension in the future or start investing in property, for example. It is worth noting that some flexible mortgages do not come with an early repayment charge but they often come with hefty fees.

Most mortgage products have an Early Repayment Charge (ERC), which is charged by your lender if you exit the mortgage earlier than stated in your terms. The charge is dependent on how early you exit the deal but usually ranges between 2% and 5% of the outstanding balance.

Even if you are not planning to move home in the next year you might need to think about the possibility of moving in the future, perhaps to start a family or a change of employment. This will dictate the length of your new mortgage if you are planning to take out a two, three or five-year mortgage.

Since getting your mortgage you may have missed a couple of payments or received a County Court Judgement, so your credit rating will no longer be as squeaky clean as it was before.

Bad credit will limit the range of lenders happy to accept your mortgage application to remortgage. Some will not accept you at all. There are things you can do to clean up your credit score but remortgaging may not be right for you now.

You have a small mortgage debt

If your mortgage debt is really small, around £50,000 or less, you may not benefit from the savings of remortgaging, especially with the higher upfront fees attached to arranging smaller mortgages.

You have a large ERC

It is best to speak to a mortgage broker about whether you could save more money in the longer term by remortgaging and paying the Early Repayment Charge; or sticking with what you have for now and reassessing your situation at a later date.

Lender or broker – who should you talk to first?

It is always worth speaking to your current lender to see what deals they are able to offer you. It is likely that they will be able to save you money on your current deal but this is only one option from the possible hundreds available on the market with other lenders.

We would always suggest speaking to a mortgage broker about what your options are. They are typically able to view products from the whole of the market and will know if your personal circumstances and affordability suit another lender’s criteria better than your current lender.

When a client comes to see us, we always look at what their current lender will offer them compared to the whole market. We will discuss the options with the client and let them know what the most cost effective deal is.

When will interest rates rise?

When will interest rates rise will always be seen as the million dollar question and to be honest no one can really predict the exact timing.

Experts are constantly trying to predict when interest rates will go up or down. Over the past few years many have been suggesting that interest rates will increase by 0.25% or 0.50% and yet last year the Bank of England decided to lower the Bank’s base rate by 0.25%.

With household incomes and spending stagnant, and with uncertainty surrounding the UK economy and our exit from the EU, it is difficult to see how the Bank of England will make any changes this year or even in the first half of 2018. So it is best to base your decisions upon the financial circumstances you can control yourself rather than those you can’t.

The battle of the fixed mortgages

The battle of the fixed mortgages

A fixed mortgage is the most popular product because people like to know how much they will spend each month on their mortgage over a set period of time. These types of mortgages are great for those who want to budget for the longer term.

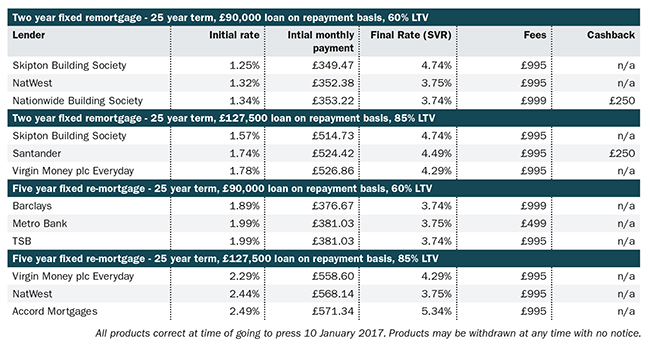

Two-year fixes have been the most popular of the fixed products over the past year due to rumours of a likely rise in interest rates. However, we now know that the Bank of England lowered rates rather than increasing them. These products also had lower interest rates than their five and ten-year cousins.

We are now seeing growing popularity in the five-year fixed mortgage thanks to lenders lowering rates and making these deals more attractive to borrowers. Uncertainty in the economy and markets has also meant that borrowers want more long-term security.

If you are planning on moving home within the next five years I would advise against a longer fixed mortgage, such as a five or 10-year product. This is because, although mortgages tend to be portable so you can move your mortgage to a new property, it is down to lending criteria at the time you port. If you don’t fit the lender’s criteria then you will be stuck paying early redemption penalties.

Having said that, the five-year fix is a good option for those looking to start a family and want more stability in terms of their financing or older clients with little time left on their mortgage.

Michelle Niziol is founder and director of mortgage broker IMS Group, based in Bicester, Oxfordshire.