Rents have increased again in March 2015, surpassing the previous year level by 2.1 per cent, the latest ONS figures show.

England and Scotland saw the same rate of increase, 2.1 per cent in the twelve months to March. The increase in Wales was considerably lower, at 0.8 per cent. England has been leading the rent growth statistics since January 2011, outpacing both Scotland and Wales. Since the beginning of 2012, English rental prices have shown annual increases ranging between 1.4 per cent and 3.0 per cent year-on-year.

England and Scotland saw the same rate of increase, 2.1 per cent in the twelve months to March. The increase in Wales was considerably lower, at 0.8 per cent. England has been leading the rent growth statistics since January 2011, outpacing both Scotland and Wales. Since the beginning of 2012, English rental prices have shown annual increases ranging between 1.4 per cent and 3.0 per cent year-on-year.

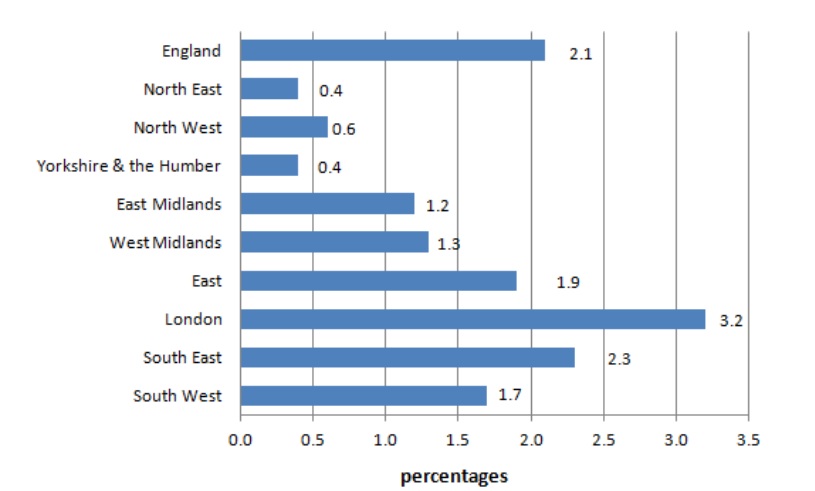

In a regional comparison, the highest rise in rents was in London (3.2 per cent). The South East ranked second with a 2.3 per cent increase followed by the East, with 1.9 per cent.

Commenting on the figures John Goodall, CEO of peer-to-peer mortgage lender Landbay, said:

“Accelerating rent rises show that we desperately need more investment in homes to let. It would be a catastrophe for the UK to turn our backs on the private rental sector right now – anti landlord rhetoric in the run up to the election is a dangerous game to play. There are just two weeks to go until polling day, however we’re yet to witness a full, frank and honest debate about the housing market.

“We are desperately short of homes and mortgage deposits are simply out of reach for many. The private rental sector can be part of the solution, giving people homes at a monthly cost they can afford. It’s important to remember rent prices have risen significantly slower than the cost of buying a house. While house prices have risen by 200% since 1996, rents have seen a cumulative increase of only 62% in the same time.

“Whilst our housing market evolves so too must our mortgage and finance industries. We need to democratise mortgage lending, and give people a real stake in property wealth. In the 21st century it seems dated and archaic to have buy-to-let profits stored away by a few at the top. Let’s share the lending profits made by banks and unleash a new era of accessible and transparent finance platforms.”