Surveyors have reported a surge in buy-to-let investors looking to beat the April stamp duty deadline which they expect will push up house prices. The Royal Institute of Chartered Surveyors said buyer enquiries rose for the tenth successive month in January with the near-term pressure on prices intensifying. It said that feedback from surveyors suggested […]

Surveyors have reported a surge in buy-to-let investors looking to beat the April stamp duty deadline which they expect will push up house prices.

Surveyors have reported a surge in buy-to-let investors looking to beat the April stamp duty deadline which they expect will push up house prices.

The Royal Institute of Chartered Surveyors said buyer enquiries rose for the tenth successive month in January with the near-term pressure on prices intensifying.

It said that feedback from surveyors suggested that the increase in demand is due to a rush of buy-to-let investors looking to purchase properties before the 3% stamp duty surcharge comes into effect in April.

Three quarters (74%) of respondents expect there to be an increase in buy-to-let purchases before the stamp duty changes are implemented.

Despite a higher level of supply, 49% of surveyors reported a price rise in January, RICS said.

According to Halifax, average house prices rose 9.7% to £212,430 in the year to January. As a result of the housing crisis, many people now fear they will never get on the property ladder. Rising prices have been blamed on the shortage of supply as well as increasing demand.

Simon Rubinsohn, RICS chief economist, said: “The rise in new instructions in January, although modest, is very welcome. However with buy-to-let investors rushing to get into the market ahead of the stamp duty hike, the near term pressure on prices is if anything intensifying despite a higher level of supply.

“How the tax changes planned for the buy-to-let sector over the next few years play out remains to be seen but there are concerns raised in the survey that some existing landlords will look to either gradually scale back on their portfolios or exit the market altogether as the more penal regime begins to bite. Against this backdrop, it is perhaps not surprising that the key RICS indicators points to further rent increases.”

Mortgage approvals

The news comes as chartered surveyor e.surv reported that growth in buy-to-let mortgage approvals had taken home lending to its highest peak in nine years.

There were 85,432 house purchase approvals in January, a rise of 20.6% from 70,837 in December, fuelled by an increase in buy-to-let investors looking to beat the upcoming stamp duty tax hike. It meant January saw the highest number of monthly house purchase approvals since 87,594 in October 2007.

House purchase lending has risen 39.3% from 61,341 approved loans in January 2015, signalling the short-term impact of a surge in buy-to-let borrowing amid the wider strength of the lending market.

Richard Sexton, director of e.surv, said: “Buy-to-let approvals contributed to the growth in January home lending. Concerns about the sector’s growth have sparked a wave of legislation but as stamp duty changes come into effect this April, there’s been a rush to get buy-to-let loans approved. Many have predicted a narrowing of the buy-to-let sector but actually what we’re seeing in lending quarters appears to be the opposite.

“This buy-to-let rise also hasn’t been at the expense of first-time buyers. The number of small-deposit loans granted has risen in January, and this is a great sign that lenders still have the appetite to give first-timers a chance. Rising wages and a delayed interest rate rise have also boosted first-timer’s prospects.”

Stamp duty

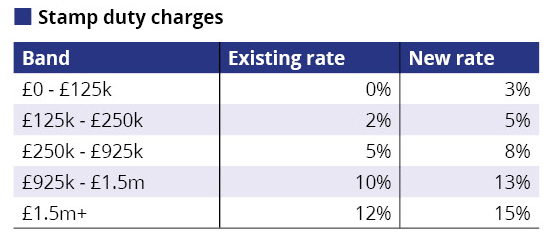

In the 2015 Autumn Statement, George Osborne dropped a bombshell with the announcement that a 3% stamp duty land tax surcharge for those buying second homes or buy-to-let properties was set to be introduced on 1 April.

The charge is part of the government’s efforts to dampen the buy-to-let market in order to make it easier for first-time buyers to get a foot on the housing ladder.

The amount of tax relief landlords can claim on properties will also fall from April 2017.

Critics have pointed out that landlords could end up charging higher rents in response, actually making it harder for tenants who want to buy to save for a deposit.

Andy Sommerville, director of Search Acumen, said: “Housing supply has risen – a drop in the ocean, but a much-needed one given the strain this early-2016 rise in house prices will place on home buyers looking to move in the first quarter, in the middle of the buy-to-let fever.

“As expected, buy-to-let reforms have the market in thrall, and surveyors, estate agents and conveyancers are going to be kept very busy in the first quarter. However, this spike is merely a redistribution of annual volumes as landlords look to complete their transactions before the April deadline. The market is going to stabilise, or even slow down slightly, once these transactions that would have otherwise happened later in the year, are complete.”