The start of the new year and the Chancellor’s recent move to abolish stamp duty for first-time buyers has likely motivated many aspiring home owners to begin exploring how they can make their dream of owning a home a reality.

“Planning to buy a home can be as daunting as it is exciting for first-time buyers but there are a number of simple steps people can take to prepare themselves and make the process as easy as possible”, says Owen Woodley, Managing Director of Post Office Money.

10 Top Tips from Post Office Money to go from Dream Home to Real Home this year:

1. Set a savings goal

Saving for a deposit is undoubtedly one of the biggest hurdles many will face, however 65% of prospective buyers also underestimate the cost of moving which many may be surprised to hear is an average of £7,590. Therefore, setting a savings target early is important to keep you focused and on track.

2. Understand your spending

One of the first steps to feeling more in control of your finances is to monitor your spending – plan in advance and review spending against this. You’ll quickly get a clear view of where you are spending your money and where you can start making cutbacks to help you save.

3. Calculate how much you can afford to borrow

Once your savings pot is up and running, consider using an affordability calculator to get an idea of how much you’ll be able to borrow based on your income and outgoings. Although this is a guide, this information will help you focus your research on properties that are within your price range.

4. Know the (credit) score

Before getting a mortgage, you will be credit checked so now is the time to check your own credit report and ensure all the information it contains is accurate and up to date. A good credit score can be the deciding factor in not only getting approved for a mortgage but also the rate you are offered. Plan now to start paying down any outstanding debt, be sure not to miss any agreed payments on utility bills or mobile phone bills and try to make more than the minimum repayment in the 6 months prior to your mortgage application.

5. Finding the right mortgage for you

Take some time to really investigate the variety of mortgages that are available for first-time buyers. Some mortgage providers such as Post Office Money, have been developing innovative mortgages to help address some of the biggest challenges facing first time buyers in the current market.

6. Time to talk

Mums and Dads are playing an increasingly important role helping many first-time buyers get on the property ladder and not only through financial gifts or loans to help with the deposit. For example, Post Office Money’s First Start mortgage lets a parent or family member’s income to be taken into account to increase your borrowing power. If your parents would like to support you, there are options available that do not involve handing over money.

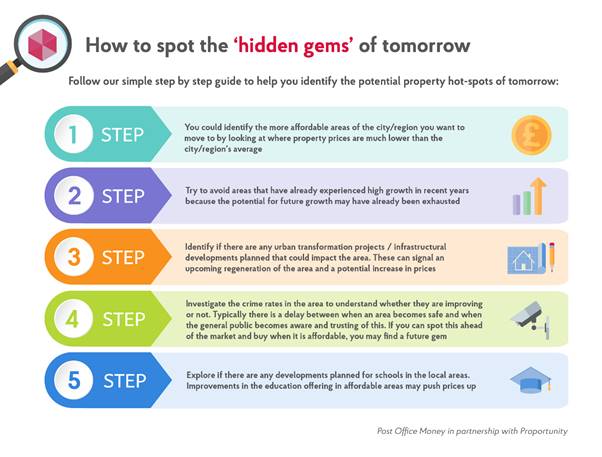

7. Research affordability hotspots

If you’re hoping to find a hidden gem in a potential property hotspot of tomorrow, follow the 5 Step guide developed by Post Office Money and Proportunity which could help you make a wise investment in your first property.

8. Know the local Rate of Sale

On average, it takes 96 days for a property to sell in the UK, but it can be as few as 61 days in Bristol. Understanding the rate at which property sells in the area you hope to buy in will help you plan ahead to move quickly if necessary and prepare for any unexpected costs if a sale takes longer than planned.

9. Broaden your horizons

In a recent Post Office Money survey of 1500 recently successful first-time buyers, the number 1 piece of advice they wanted to pass on was to be flexible when it comes to your dream location. In fact, 70% chose to buy a home an average of 26 minutes from their original ‘preferred’ location.

10. Ready… in principle

While an agreement in principle will help ensure you are taken seriously when you begin your property search, be cautious of applying for too many as each credit search will leave a mark on your credit report. While not a guarantee it will give you a better idea of how much you will be able to borrow from that lender and it remains valid for 60-90days.

For free independent mortgage advice visit the What Mortgage Advice Centre

Excellent read. Thanks for sharing this informative article. Keep it up